Budgeting Made Easy: 50 30 20 Budget Notion Template

In this guide, we will explore how to create a 50 30 20 Budget Notion Template to simplify your budgeting process and take control of your financial future.

Budgeting can often feel overwhelming, but it doesn’t have to be. The 50/30/20 budgeting rule is a straightforward method that can help you manage your finances effectively without sacrificing your lifestyle.

Table of Contents

Understanding the 50/30/20 Budgeting Rule

What is the 50/30/20 Budgeting Method?

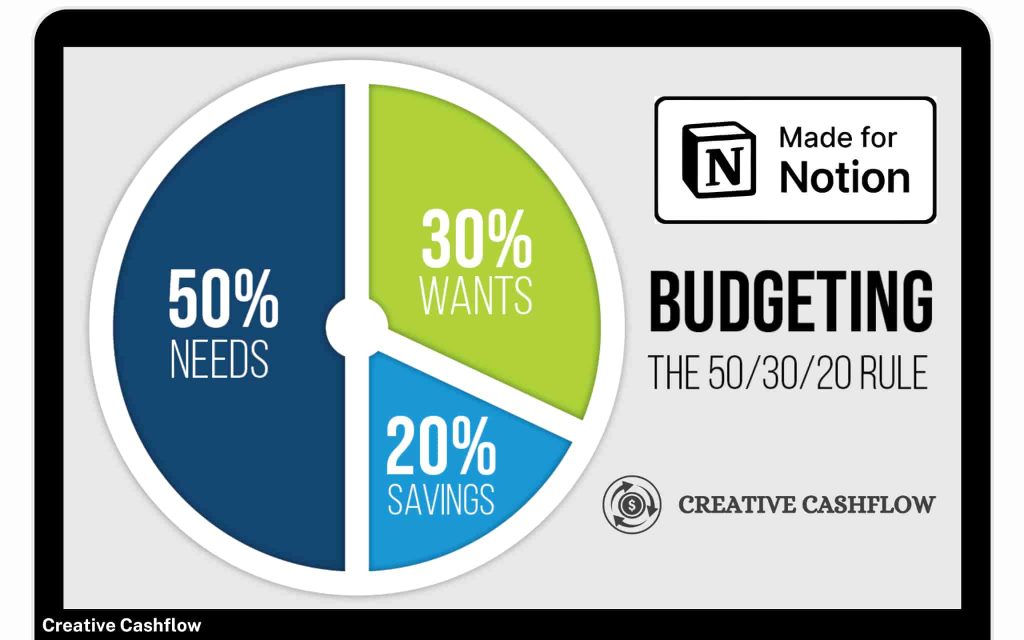

The 50/30/20 rule is a simple guideline for allocating your income. It divides your after-tax income into three categories:

- 50% for Needs: This includes essential expenses such as housing, utilities, groceries, transportation, and healthcare. These are non-negotiable costs that you must pay to maintain your basic standard of living.

- 30% for Wants: This category covers discretionary spending such as dining out, entertainment, travel, and other non-essential purchases. While these are not necessary for survival, they contribute to your quality of life.

- 20% for Savings and Debt Repayment: This portion is crucial for long-term financial health. It includes contributions to savings accounts, retirement funds, and paying off debts. Prioritizing this category helps build financial security and prepares you for future expenses.

The beauty of the 50/30/20 method lies in its simplicity. By categorizing your income this way, you can quickly assess your spending habits and identify areas for improvement.

Why Choose the 50/30/20 Rule for Your Budget?

There are several compelling reasons to adopt the 50 30 20 budget method:

- Simplicity: The method is easy to understand and implement, making it accessible for anyone, regardless of financial literacy.

- Flexibility: This budgeting approach can be adjusted based on different income levels and personal circumstances. You can modify the percentages as needed to fit your financial goals.

- Balanced Approach: By allocating funds to both needs and wants, you can enjoy a fulfilling lifestyle while still saving for the future.

- Encouragement of Savings: The designated savings portion helps you build wealth over time, promoting better financial habits.

50 30 20 Budget Notion Template

Getting Started with Your 50/30/20 Budget Notion Template

What is Notion and How Can It Help?

Notion is a powerful productivity tool that combines note-taking, task management, and database functionalities into one platform. It allows users to create customizable templates, making it an ideal choice for budgeting.

With Notion, you can:

- Organize financial data: Easily input your income and expenses in one place.

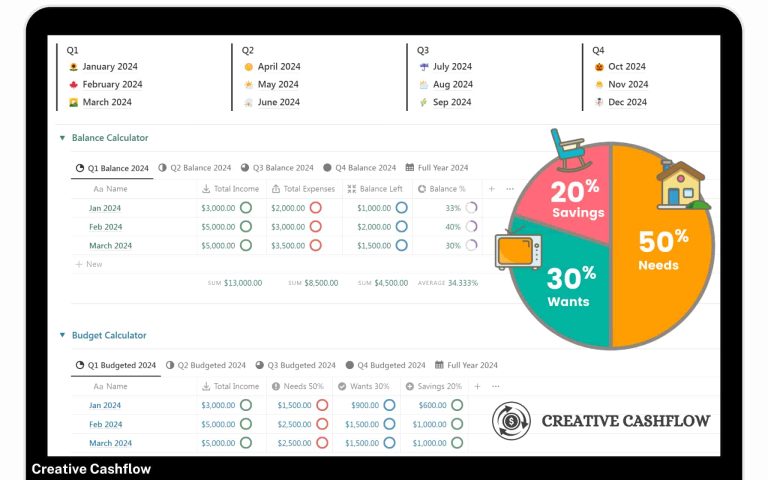

- Visualize your budget: Create charts and graphs to track your spending and savings.

- Collaborate: Share your budgeting template with family or friends for joint planning.

Using a 50 30 20 Budget Notion Template can streamline your budgeting process and help you stay organized.

Setting Up Your 50/30/20 Budget Notion Template

To create your 50 30 20 Budget Notion Template, follow these steps:

- Create a New Page: Open Notion and create a new page for your budget.

- Add Income Section: Create a section to input your income sources, including salary, freelance work, and any other revenue streams.

- Categorize Expenses: Set up tables or sections for needs, wants, and savings/debt repayment.

- Visualize Data: Use Notion’s database feature to create charts that show your spending habits over time.

- Customize: Tailor your template with colors and layouts that suit your preferences.

50 30 20 Budget Notion Template

Inputting Your Financial Information

How to Record Your Income in Notion

Accurate income tracking is essential for effective budgeting. Begin by listing all sources of income in your 50 30 20 Budget Notion Template. This could include:

- Primary Salary: Your main source of income.

- Side Hustles: Freelancing, tutoring, or any additional work.

- Investments: Income from stocks, bonds, or rental properties.

It’s important to account for any variability in income, particularly if you have side gigs. You can average your income over several months to ensure stability in your budgeting.

Categorizing Your Expenses

To effectively use the 50 30 20 Budget Notion Template, accurately categorize your expenses: Budgeting is made simple with the 50/30/20 budget rule, which splits your after-tax income into three categories: Needs, Wants, and Savings. This principle offers an effective strategy for managing your finances:

- Spend 50% of your money on Needs: To follow this budget, 50% of your after-tax income should be spent on your needs. Needs are payments for essential expenses that are difficult to live without, including monthly rent, electricity and gas bills, transportation, insurance (for healthcare, car, or pets), minimum loan repayments, and basic groceries. For example, if your monthly after-tax income is $2000, $1000 should be allocated to your needs.

- Spend 30% of your money on Wants: 30% of your after-tax income can be used for your wants. Wants are non-essential expenses, such as dining out, shopping for clothes, holiday trips, gym memberships, entertainment subscriptions (Netflix, HBO, Amazon Prime), etc. Using the same example above, if your monthly after-tax income is $2000, you can spend $600 for your wants.

- Stash 20% of your money for Savings: 20% of your monthly income should be saved to achieve your savings goals or pay back any outstanding debts. Consistently putting aside 20% of your pay each month can help you build a better savings plan. For example, if you bring home $2000 after tax each month, you could put $400 towards your savings goals. In just a year, you’ll have saved close to $5000!

To determine what falls into each category, ask yourself whether you could live without it. If the answer is yes, it likely belongs in the wants category.

Allocating Your Savings and Debt Payments

The 20% allocation for savings and debt repayment is critical for long-term financial health. Consider the following strategies:

- Emergency Fund: Aim to save at least three to six months’ worth of living expenses.

- Retirement Savings: Contribute to a 401(k) or IRA to secure your financial future.

- Debt Repayment: Focus on high-interest debt first (like credit cards) before tackling lower-interest loans.

In your Notion template, create a section to track progress towards your savings goals and debt payments. Regularly updating this section will help you stay motivated.

50 30 20 Budget Notion Template

Making the Most of Your 50/30/20 Budget Notion Template

Regularly Reviewing Your Budget

Budgeting is not a one-time task; it requires regular reviews. Set aside time each month to assess your spending and savings. During these reviews, consider the following:

- Are you staying within your allocated percentages?

- Have any expenses increased significantly?

- Are you on track to meet your savings goals?

You can use Notion’s database features to generate reports that visualize your spending patterns over time. This data will help you make informed adjustments to your budget.

Staying Motivated and Engaged with Your Budget

Maintaining motivation is crucial for successful budgeting. Here are some tips to help you stay engaged with your 50 30 20 Budget Notion Template:

- Set Small Goals: Break down your savings goals into smaller, achievable milestones.

- Celebrate Wins: Acknowledge when you meet your goals, whether big or small.

- Use Visual Aids: Create charts in Notion that display your progress. Seeing your savings grow can be a powerful motivator.

50 30 20 Budget Notion Template

Common Budgeting Challenges and Solutions

Managing Impulse Spending

One of the biggest challenges in budgeting is impulse spending. Here are some strategies to mitigate this:

- Create a Waiting Period: Implement a 24-hour rule before making non-essential purchases.

- Limit Access: Use cash for discretionary spending to avoid overspending with cards.

- Track All Expenses: Use your Notion template to log every purchase, which can help you identify triggers for impulse spending.

Handling Unexpected Expenses

Unexpected expenses can derail even the best budgets. To prepare:

- Build a Buffer: Ensure your budget has a small cushion for unexpected costs.

- Adjust Budget: If an unexpected expense arises, review your budget in Notion and make necessary adjustments.

Conclusion

The 50/30/20 budgeting method is a powerful tool for achieving financial stability and reaching your goals. By implementing the 50 30 20 Budget Notion Template, you can simplify your budgeting process and take control of your finances.

Simplify your financial journey with our thoughtfully designed 50 30 20 budget rule notion template. Easily track income, expenses, and savings to gain a clear understanding of your financial health and identify areas for improvement, so you can make informed financial decisions.

50 30 20 Budget Notion Template

“Thanks for reading! I hope you enjoyed this post. What are your thoughts on this topic? Let me know in the comments below. Until next time!”

FAQs

1. How can a Notion template help with budgeting?

A 50 30 20 Budget Notion Template allows you to organize your financial data in one place. Notion’s customizable features enable you to track your income, categorize expenses, and visualize your budget through charts and graphs. This makes it easier to monitor your financial health and make informed decisions.

2. Why purchase a pre-made Notion template instead of creating one from scratch?

Building a budgeting template from scratch can be time-consuming and challenging, especially if you’re not familiar with Notion’s features. By purchasing our 50 30 20 Budget Notion Template, you save time and effort while gaining access to a professionally designed tool that simplifies your budgeting process.

3. How often should I review my budget?

It’s recommended to review your budget at least once a month. Regular reviews help you assess your spending habits, identify any changes in expenses, and ensure you are on track to meet your savings goals. This practice allows you to make necessary adjustments to your budget as needed.

4. What if my expenses fluctuate from month to month?

If your expenses vary, consider averaging your monthly expenses over several months to create a more stable budget. You can also build a buffer into your budget to accommodate unexpected costs. The flexibility of the 50 30 20 budgeting method allows you to adjust your allocations as needed.

5. Can I modify the 50/30/20 rule to fit my financial situation?

Absolutely! The 50/30/20 rule is a guideline, not a strict rule. You can adjust the percentages based on your unique financial situation and goals. For example, if you have high debt, you might allocate more than 20% to savings and debt repayment.

6. How do I stay motivated while budgeting?

Staying motivated can be challenging, but setting small, achievable goals can help. Celebrate your milestones, whether big or small, and use visual aids in your Notion template to track your progress. Seeing your savings grow can provide a significant boost to your motivation.

50 30 20 Budget Notion Template

Get more insights from me.

- If you love my content, you can Buy Me a Coffee here.

- Want to read more from me: subscribe to my newsletter, Creative Cashflow Newsletter.

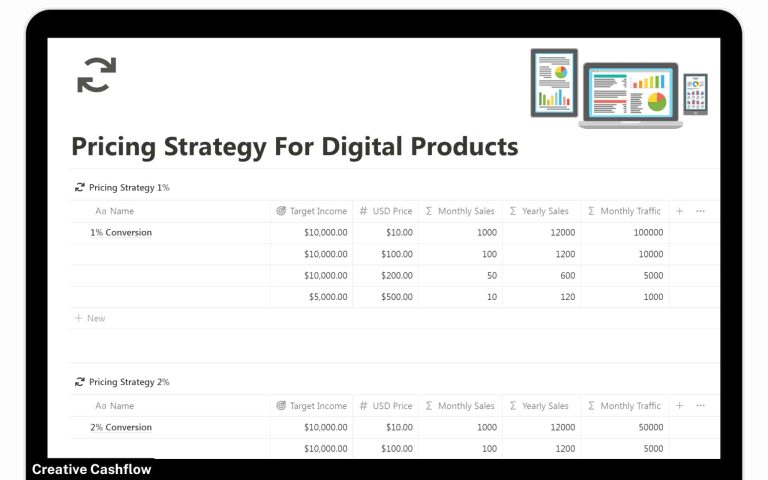

- Want a system to manage your Finances: grab my 50/30/20 Savings Rule Zero Based Budgeting Notion Template

- Tool I personally recommend: System.io , CreativeFabrica & VidIQ

- Check My Social media profile: Twitter, YouTube & Bento.me Profile

- Learn how to make money online with Solopreneur Success Plan

“Please note: This post may contain affiliate links. If you purchase a product through one of these links, I may earn a small commission at no additional cost to you. Thank you for your support!”