Simplify Your Finances With Ultimate 50/30/20 Budget Rule Finance Tracker

Managing your finances can often feel overwhelming, especially with the myriad of expenses we face daily. However, budgeting doesn’t have to be complicated.

Enter the 50/30/20 budget rule finance tracker—a straightforward and effective way to allocate your income. In this blog post, we’ll explore how you can simplify your financial life with the Ultimate 50/30/20 Budget Rule Finance Tracker, designed specifically as a Google Sheets template.

Achieve Financial Freedom by Simplifying Your Finances with Our User-Friendly, Intuitive & Easy to use (Google Spreadsheet Budget Template), Track Your Money with This 50/30/20 Budget Rule Finance Tracker!

Table of Contents

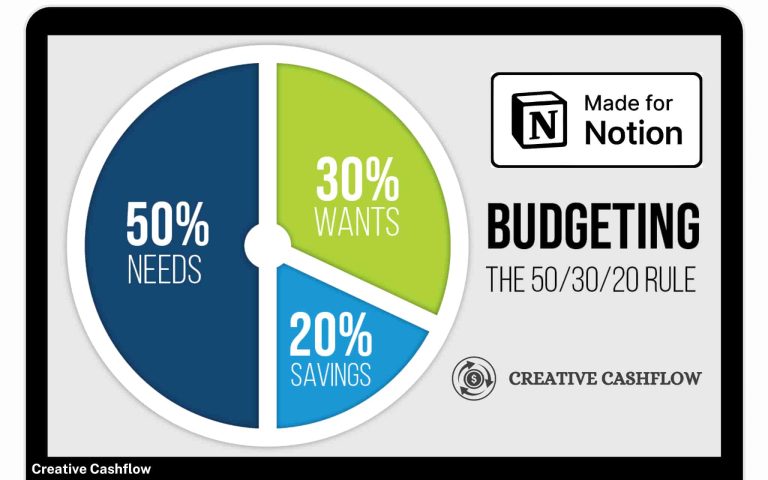

What is the 50/30/20 Budget Rule?

The 50/30/20 budget rule is a simple framework for managing your income effectively. It divides your after-tax income into three categories:

- 50% for Needs: This includes essential expenses like housing, utilities, groceries, transportation, and healthcare. These are the costs you must cover to maintain your basic standard of living.

- 30% for Wants: This category encompasses discretionary spending. Think of dining out, entertainment, vacations, and other non-essential expenses that bring joy to your life.

- 20% for Savings and Debt Repayment: This portion should go toward building your savings, investing for the future, or paying off any existing debts.

By adhering to this rule, you can better manage your finances, ensure you’re saving for the future, and enjoy your earnings without guilt.

Why Use a Finance Tracker?

Using a finance tracker is essential for maintaining accountability and clarity in your budgeting process. A well-designed tracker allows you to:

- Visualize Your Spending: Seeing where your money goes each month helps you identify trends and make necessary adjustments.

- Stay on Track: Regularly updating your tracker ensures you remain within your budget limits, preventing overspending.

- Plan for the Future: By tracking your income and expenses, you can set realistic financial goals and work toward achieving them.

Introducing: The Ultimate 50/30/20 Budget Rule Finance Tracker

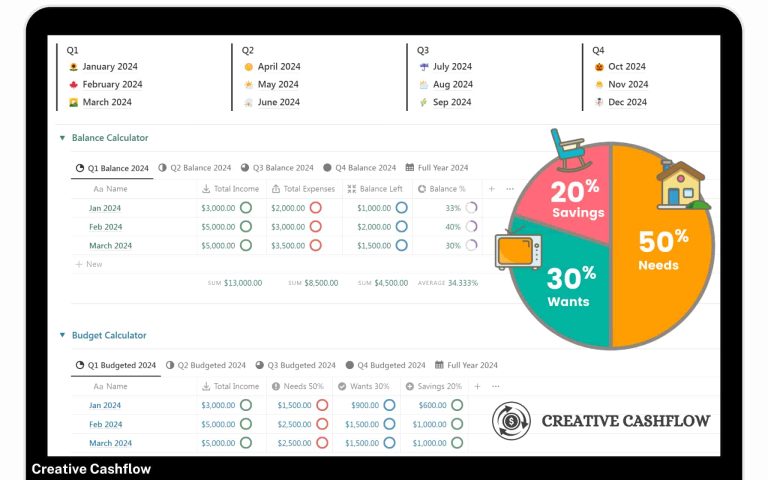

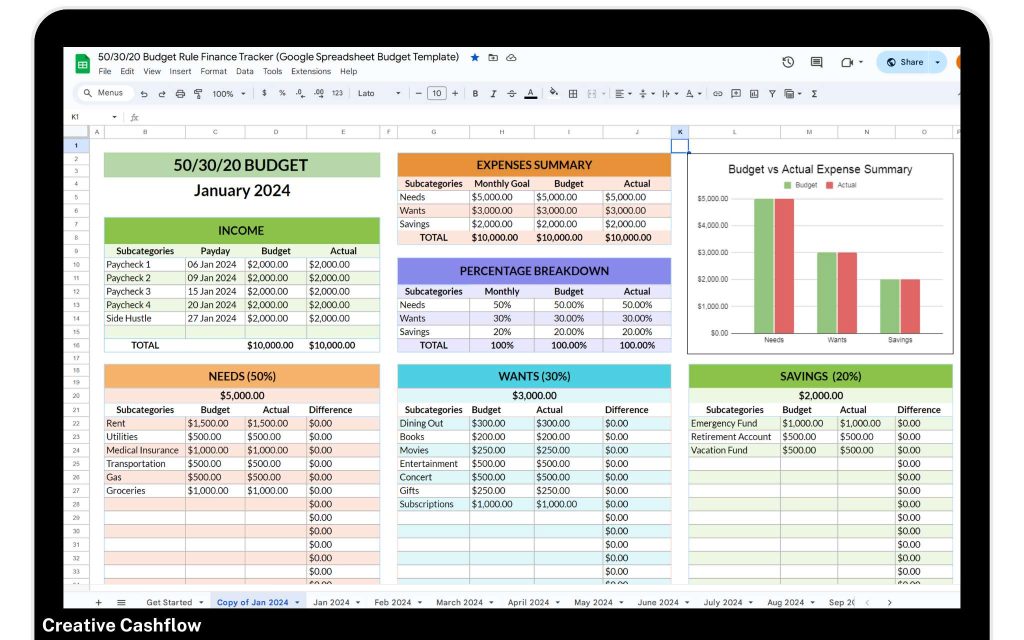

Our Ultimate 50/30/20 Budget Rule Finance Tracker is a comprehensive Google Sheets template designed to make your budgeting process seamless and effective. Here are some of its standout features:

1. User-Friendly Interface:

The template is designed with simplicity in mind, making it easy for anyone—regardless of their financial savvy—to navigate.

2. Automatic Calculations:

No more manual calculations! The tracker automatically calculates your percentages for needs, wants, and savings, giving you instant feedback on your spending habits.

3. Customizable Categories:

While the template comes with default categories, you can easily customize them to reflect your unique financial situation and preferences.

4. Monthly Overview:

The tracker provides a monthly overview of your finances, allowing you to see your progress and make data-driven decisions.

5. Visual Charts and Graphs:

To make financial analysis easier, the template includes visual representations of your spending habits, helping you quickly identify areas for improvement.

Conclusion

Simplifying your finances doesn’t have to be a daunting task. With the Ultimate 50/30/20 Budget Rule Finance Tracker, you can take control of your spending, save for the future, and enjoy your life without financial stress.

Download the template today, and start your journey toward better financial health!By embracing the 50/30/20 budgeting method, you’re not just managing your money; you’re empowering yourself to make informed financial decisions that will benefit you for years to come. Happy budgeting!

“Thanks for reading! I hope you enjoyed this post. What are your thoughts on this topic? Let me know in the comments below. Until next time!”

FAQs

1. How do I set up the Google Sheets template?

The template is designed to be user-friendly. Simply input your monthly income and expenses into the designated cells, and the template will automatically calculate your spending based on the 50/30/20 rule.

2. Can I track multiple income sources or expenses with this template?

Yes, the template allows you to track multiple income streams and categorize various expenses to get a comprehensive view of your finances.

3. Can I customize the percentages in the 50/30/20 rule?

Yes, you can adjust the percentages to fit your specific financial situation. For example, if you have a high debt burden, you might allocate a larger portion to debt repayment.

Get more insights from me.

- If you love my content, you can Buy Me a Coffee here.

- Want to read more from me: subscribe to my newsletter, Creative Cashflow Newsletter.

- Want a system to manage your Finances: grab my 50/30/20 Savings Rule Zero Based Budgeting Notion Template

- Tool I personally recommend: System.io , CreativeFabrica & VidIQ

- Check My Social media profile: Twitter, YouTube & Bento.me Profile

- Learn how to make money online with The Art Of X Tweeter

“Please note: This post may contain affiliate links. If you purchase a product through one of these links, I may earn a small commission at no additional cost to you. Thank you for your support!”